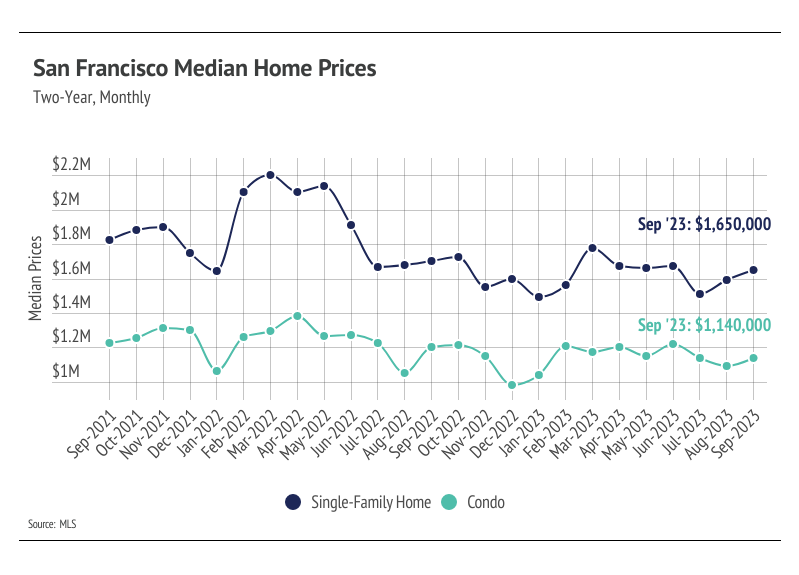

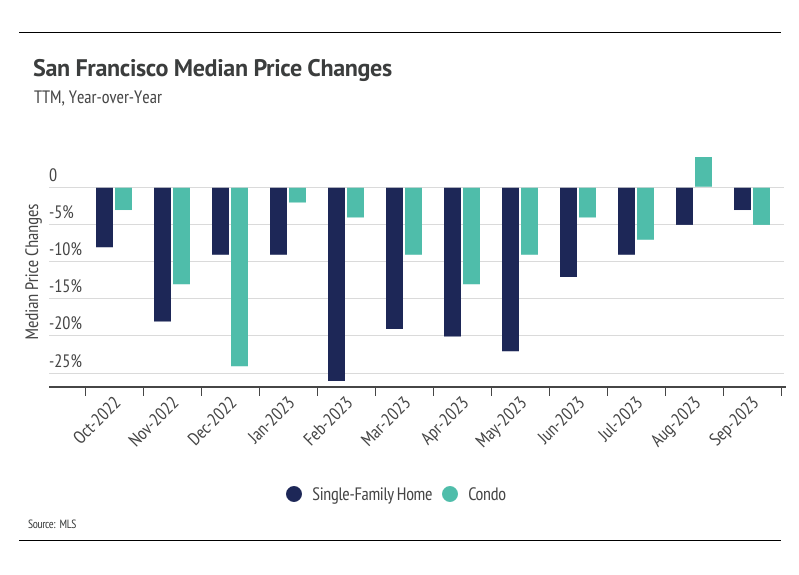

In San Francisco, the price of housing is sticky — even during a period of rapidly rising mortgage rates. When mortgage rates shot up in 2022, prices contracted in the second half of the year. Since then, prices haven’t experienced huge variances. Year to date, prices of both single-family homes and condos have increased, up 3% and 14%, respectively.

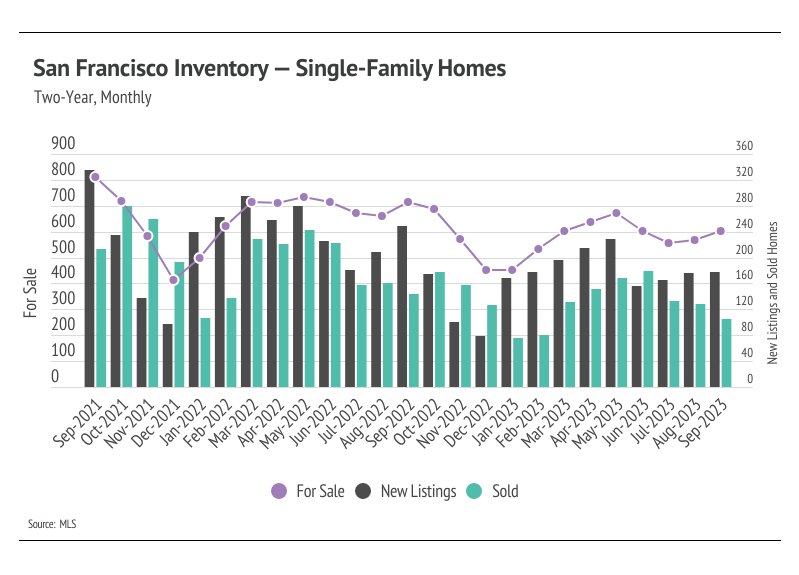

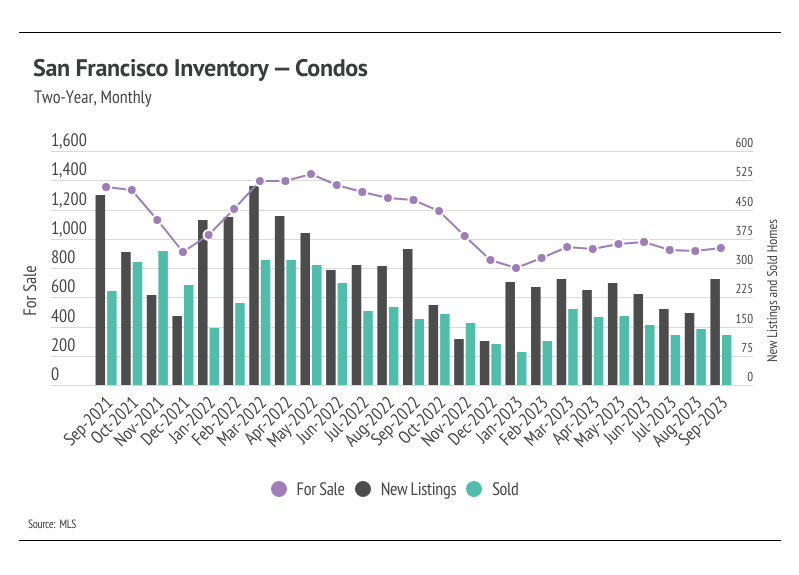

The persistently low inventory and low number of new listings will create price support in the slower fall and winter seasons. Typically, demand begins to decline in the fall and bottoms out in January, so the consistently low supply should be less of an issue. With mortgage rates at a 23-year high, quality listings are going to have the most competition. This isn’t unusual, but potential homebuyers aren’t nearly as willing to pay a premium for a fixer upper as they were in 2020 and 2021.

Low inventory is here to stay

Since the start of 2023, single-family home inventory has followed fairly typical seasonal trends, but at a significantly depressed level. Low inventory and fewer new listings have slowed the market considerably. Typically, inventory peaks in July or August and declines through December or January, but the lack of new listings prevented meaningful inventory growth. Even though demand is softening due to higher interest rates and normal seasonality, inventory is so low that any amount of new listings is good for the market. Comparing new listings from January through September 2023 to the same time period in 2022, new listings are down 24%, which has directly impacted both inventory and sales. The number of home sales is, in part, a function of the number of active listings and new listings coming to market. Sales are down 26% year over year.

As demand slows, buyers are gaining slightly more negotiating power and paying less than asking price on average. The average seller received 96% of list in January, which grew to 102% by June. The amount sellers are receiving is starting to decline, and by September 2023, the average seller received 99% of list. That being said, inventory will almost certainly remain constrained for the rest of the year, and likely remain low in 2024, which will create price support and at least minor competition among buyers.

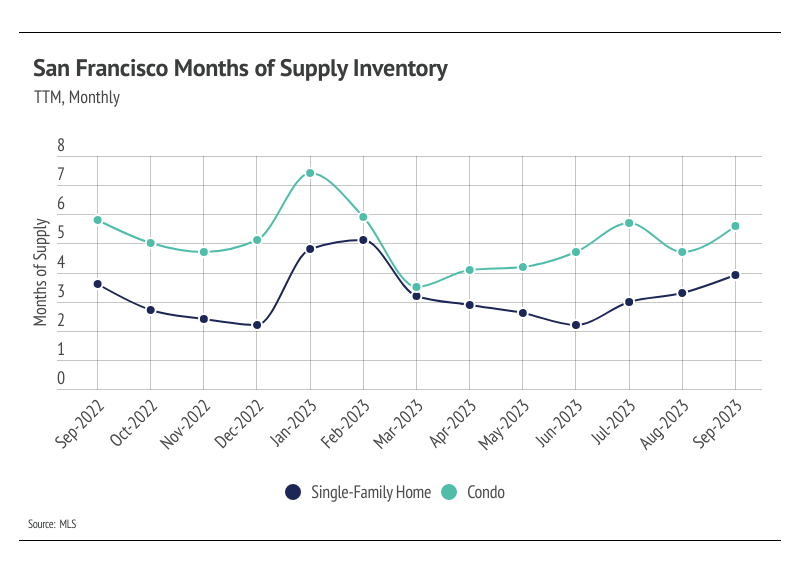

Months of Supply Inventory indicates the market now favors buyers for single-family homes

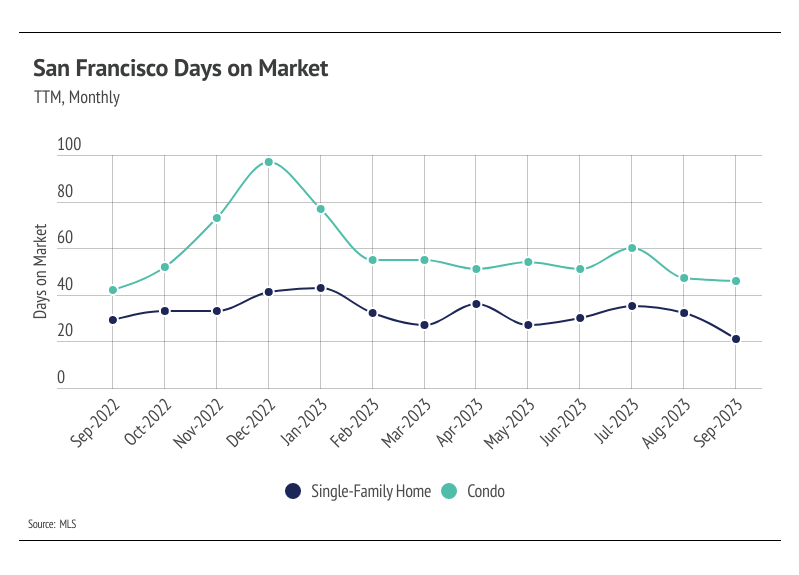

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). The San Francisco market tends to favor sellers, at least for single-family homes, which is reflected in its low MSI. However, we’ve seen over the past 12 months that this isn’t always the case. MSI indicated that single-family homes and condos began the year in a buyers’ market. MSI declined in the first half of the year for single-family homes, indicating that the climate shifted from a buyers’ market to a sellers’ market. However, over the past three months, MSI has risen substantially, now indicating a buyers’ market once again. Condo MSI moved from a balanced market at the end of the first quarter of 2023 back to a buyers’ market. These transitions occurred largely due to the substantial drop in sales since the start of summer.

Local Lowdown Data

--------------------------

If you are interested in selling, buying or just curious about the

San Francisco and Bay Area real estate market, please give me a call.

We are here to help you and anyone you care about.

--------------------------